real property taxes las vegas nv

Job in Las Vegas - Clark County - NV Nevada - USA 89105. 4Transmits to the State of Nevada all Real Property Transfer Taxes collected minus a.

What S The Property Tax Outlook In Las Vegas Mansion Global

Which may also include real estate taxes and a portion of the buildings.

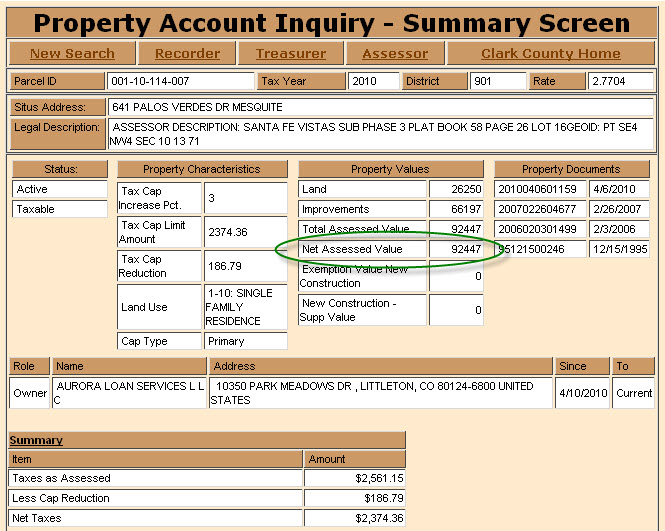

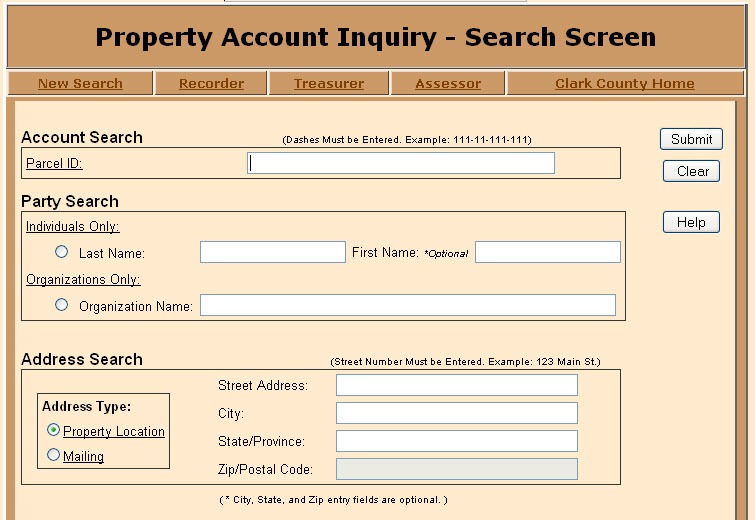

. Lets see an example of how this formula works. Property Account Inquiry - Search Screen. What seems a large increase in value may only produce an insignificant boost in your tax payment.

If youre thinking about buying a home in Las Vegas Nevada learning about the property taxes in the area will help you prepare ahead. Las Vegas Nevada 89155-1220. See Property Records Tax Titles Owner Info More.

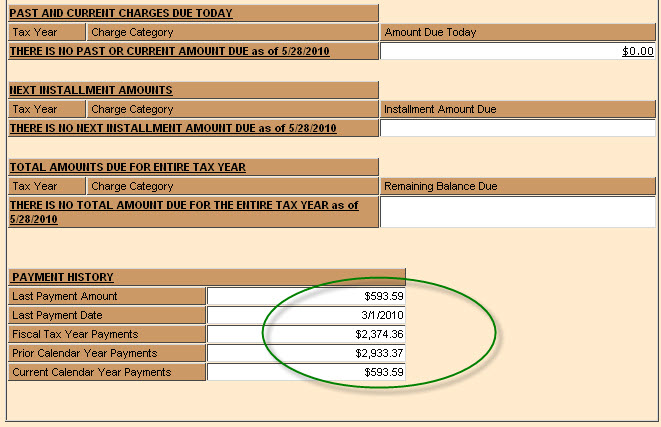

If real property is purchased during the fiscal year or if a mortgage company is no longer responsible for making tax payments call our office to request a bill at 702-455-4323. Las Vegas NV 89106. Clark County collects on average 072 of a propertys assessed fair market value as property tax.

The states average effective property tax rate is just 053. States with the lowest property taxes. The median property tax in Clark County Nevada is 1841 per year for a home worth the median value of 257300.

Account Search Dashes Must be Entered. Las Vegas Property Taxes - how to calculate property taxes in Nevada and how to learn more. Please verify your mailing address is correct prior to requesting a bill.

Clark County has one of the highest median property taxes in the United States and is ranked 546th of the 3143 counties in order of median property taxes. PROGRAM OF THE GREATER LAS VEGAS ASSOCIATION OR REALTORS MLS. Skip to main content.

North Las Vegas determines tax levies all within Nevada regulatory directives. 123 Main St City State and Zip entry fields are optional. Property Tax Rates for Nevada Local Governments Redbook NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues generated by those taxes.

Zillow has 5041 homes for sale in Las Vegas NV. Reserved for the county however are appraising property mailing bills making collections carrying out compliance and dealing with conflicts. Army Navy Marines Air Force Coast Guard the National Guard or Reserves while on active duty and the Merchant Marine during time of war or national.

2Reviews applications for exemption and determines whether the transaction qualifies. Facebook Twitter Instagram Youtube NextDoor. Compared to the 107 national average that rate is quite low.

You can expect to see property taxes calculated at about 5 to 75 of the homes purchase price. As a general rule of thumb annual estimated property taxes can be calculated at roughly 5-75 of the purchase price. Carefully determine your actual real property tax including any tax exemptions that you are qualified to have.

Tax bills requested through the automated system are sent to the mailing address on record. Additionally the City of Las Vegas charges 05 city sales tax the City of Henderson also charges their sales tax percentage. The figure you are left with is your capital gain on the property and based on your non-property income you will have to pay up to 30 in federal and state taxes on your capital gains.

Make Real Property Tax Payments. The low rate on property taxes is one of the main. REAL ESTATE LISTINGS HELD BY BROKERAGE FIRMS OTHER THAN THIS SITE OWNER ARE MARKED WITH THE IDX LOGOINFORMATION DEEMED RELIABLE BUT NOT.

111-11-111-111 Address Search Street Number Must be Entered. Real PropertyVehicle Tax Exemptions Nevada Wartime Veterans Tax Exemption applies to residents who have served in the Armed Forces of the United States in any of the following branches. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

Search Any Address 2. Sales Tax State Local Sales Tax on Food. 028 effective real estate tax rate.

In Las Vegas NV the estimated annual property taxes can be calculated at roughly 5 to 75 of the home purchase price. What is the Property Tax Rate for Las Vegas Nevada. Las Vegas NV 89155-1220.

The property tax rates in Nevada are some of the lowest in the nation. Access to Market Value Tax Info Owners Mortgage Liens Even More Property Records. The average effective property tax rate in Nevada is 053 while the national average is 107.

Business Life Style Real Estate Property Taxes in Las Vegas 2022. Real property tax on median home. State Local Tax Manager.

Counties carry out real estate appraisals for North Las Vegas and special purpose public entities. Ad Get In-Depth Property Reports Info You May Not Find On Other Sites. In Nevada the market value of your property determines property tax amounts.

The amount of property taxes a homeowner pays is determined by multiplying the tax. Las Vegas NV 89155. The Clark County Tax Assessor-website Collector has further information.

Thus if the Clark County Assessor determines your homes taxable value is 100000 your assessed value will be 35000. Checks for real property tax payments should be made payable to Clark County Treasurer. The State of Nevada sales tax rate is 46 added to the Clark County rate of 3775 equals 8375.

Technically the Las Vegas sales tax rate is between 8375 and 875. You purchased a rental property 8 years ago for 200000 and put 20 percent down with a standard 6 fixed rate. To ensure timely and accurate posting please write your parcel numbers on the check and.

Don C Send an email February 14 2022. The assessed value is equal to 35 of the taxable value. Nevada is ranked number twenty four out of the fifty states in order of the average amount of property taxes collected.

2250 Las Vegas Boulevard NorthSuite 200North Las Vegas NV 89030Phone 702 633 1213Fax 702 399 1716 Manager Lorena Candelario SR WA Senior Office Assistant Tracee Hales Real Property Services assists City departments in all facets of real estate transactions providing strategic advice and purchasing property rights for City projects ranging from street rights. Payment Options for Real Property Taxes only Mail. 3Collects the tax when the transfer of property is recorded.

This public search page can be used to determine current property taxes for any property in Las Vegas and Henderson. Counties in Nevada collect an average of 084 of a propertys assesed fair market value as property tax per year. View listing photos review sales history and use our detailed real estate filters to find the perfect place.

When going to court property owners usually order service of one of the best property tax attorneys in Las Vegas NV. 1Determines the amount of the tax required based on the value as represented on the Declaration of Value. You may find this information in Property Tax Rates for Nevada Local Governments commonly called the Redbook.

041 effective real estate tax rate. 0 76 2 minutes read. The median property tax in Nevada is 174900 per year for a home worth the median value of 20760000.

Search Valuable Data On Properties Such As Liens Taxes Comps Foreclosures More. Please visit this page for more information. Once every 5 years your home is required to be re-appraised by County Assessors.

Our Rule of Thumb for Las Vegas sales tax is 875. In addition Nevadas tax abatement law protects homeowners from sudden spikes in their property taxes. The Clark County Treasurer provides an online payment portal for you to pay your property taxes.

Homeowners in Nevada are protected from steep increases in property tax bills by Nevadas property tax abatement law which limits annual increases in property tax bills to a maximum of 3 for homeowners. Tax rates apply to that amount.

Living In Las Vegas Nv Pros And Cons Of Moving To Las Vegas 2022 Retirebetternow Com

Mesquitegroup Com Nevada Property Tax

Mesquitegroup Com Nevada Property Tax

Calculating Las Vegas Property Taxes Las Vegas Real Estate Las Vegas Homes For Sale Las Vegas Real Estate

Calculating Las Vegas Property Taxes Las Vegas Real Estate Las Vegas Homes For Sale Las Vegas Real Estate

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Cortez Masto Introduces Clark County Lands Bill To Expand Las Vegas Footprint Designate Public Land For Conservation The Nevada Independent

Mesquitegroup Com Nevada Property Tax

Nevada Is The 9 State With The Lowest Property Taxes Stacker

Enterprise Real Estate Enterprise Las Vegas Homes For Sale Zillow

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Top 10 Reasons To You Should Move To Las Vegas Nv

Las Vegas Area Clark County Nevada Property Tax Information

Nevada Tax Rates And Benefits Living In Nevada Saves Money

Nevada Vs California Taxes Explained Retirebetternow Com

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty